8 Best Freelance Websites to Hire Great Freelancers [2025]

Discover Which Site Is Best for Your Needs

In our quest to discover the most reliable freelance websites, we examined and evaluated all the leading platforms in the industry. We thoroughly tested every website’s search engine, freelancer profiles, general pricing, and support to ensure a smooth and efficient hiring process. Only the freelance sites that performed exceptionally well and satisfied our rigorous standards made it on this list. Read on to find out which ones you can really count on.

-

![8-best-freelance-websites-to-hire-great-freelancers-5678tg-1.png]()

- The most budget-friendly platform

- Real-time collaboration tools

- A wide range of job types available

- 100% safe payment system

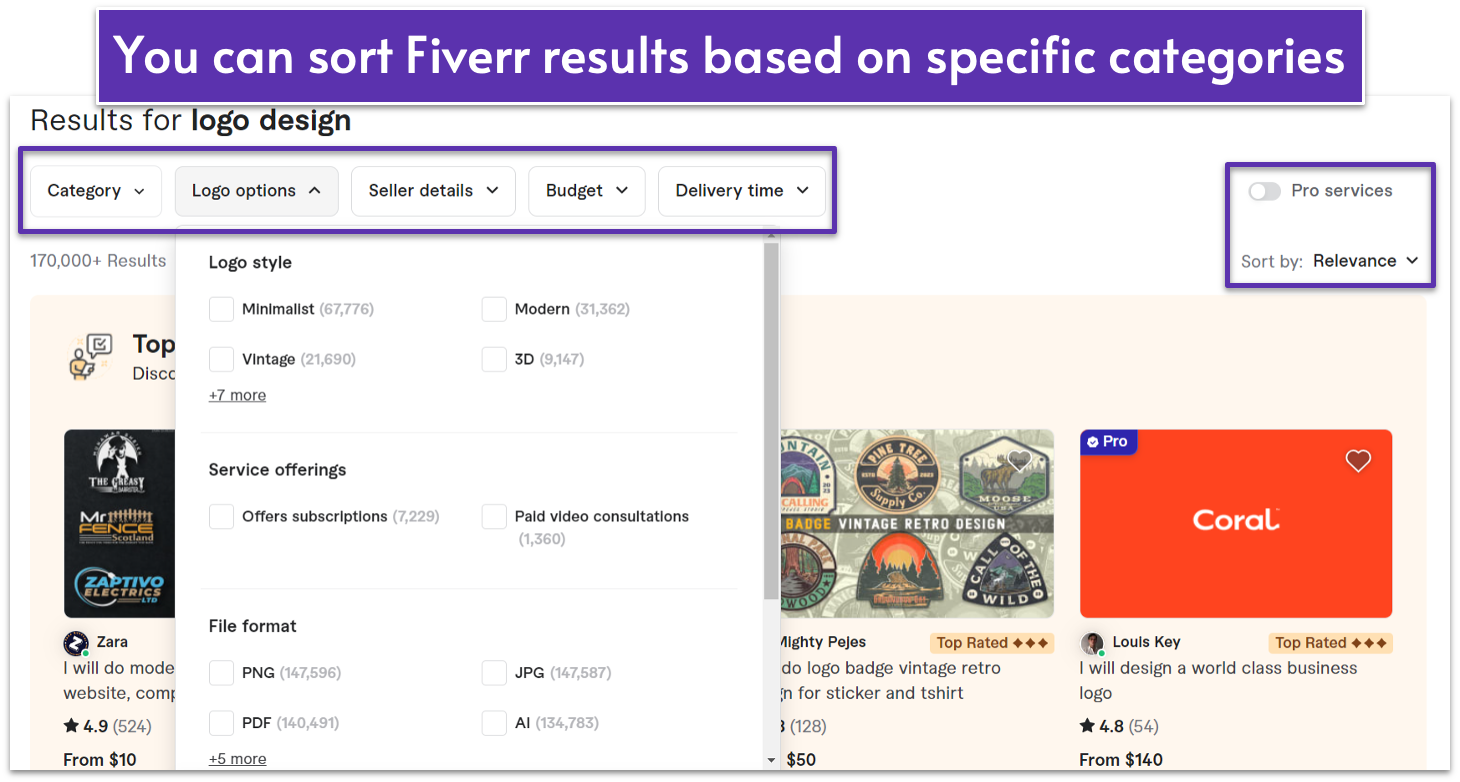

With hundreds of thousands of freelancers in over 500 categories, Fiverr is one of the most well-known freelance platforms. One thing that really stands out is Fiverr’s affordable prices: you can hire a professional for any job you need for as little as $5. But if you want top quality and are willing to spend more, you can also get experienced freelancers with sparkling reviews.On Fiverr, projects are paid by the job, meaning the total price is set when you hire the freelancer. Extras, such as faster-than-usual delivery, are listed as options by the freelancer. You can add them to your order with the gig. I like this neat, centralized approach.

Fiverr is known for fixed-price projects. However, with the new Subscriptions feature, you can secure the freelancers you like for ongoing work. You can subscribe for a gig for up to six months. During this time, you can update the requirements for individual orders. Plus, you can create your own schedule and pay with each order, which provides plenty of flexibility. Nearly every gig category offers Subscriptions, though it depends on individual freelancers.

Another thing I like about Fiverr is how easy it is to find qualified and reputable freelancers. Fiverr’s rating system considers delivery time, customer satisfaction, and service quality, making it easy to find hidden gems. There’s Fiverr Pro, which allows you to hire top-tier, pre-vetted freelancers in most digital service categories, and you also get AI-powered freelancer suggestions based on your preferences and project history.

Top freelance categories: Graphic design/logo design, website design, writing, voiceover recordings, social media

-

![8-best-freelance-websites-to-hire-great-freelancers-5678tg-2.png]()

- Gigantic talent pool

- Best choice for long-term relationships

- Work diary, management tools, and easy monitoring

- Low fee and advanced Payment Protection plan

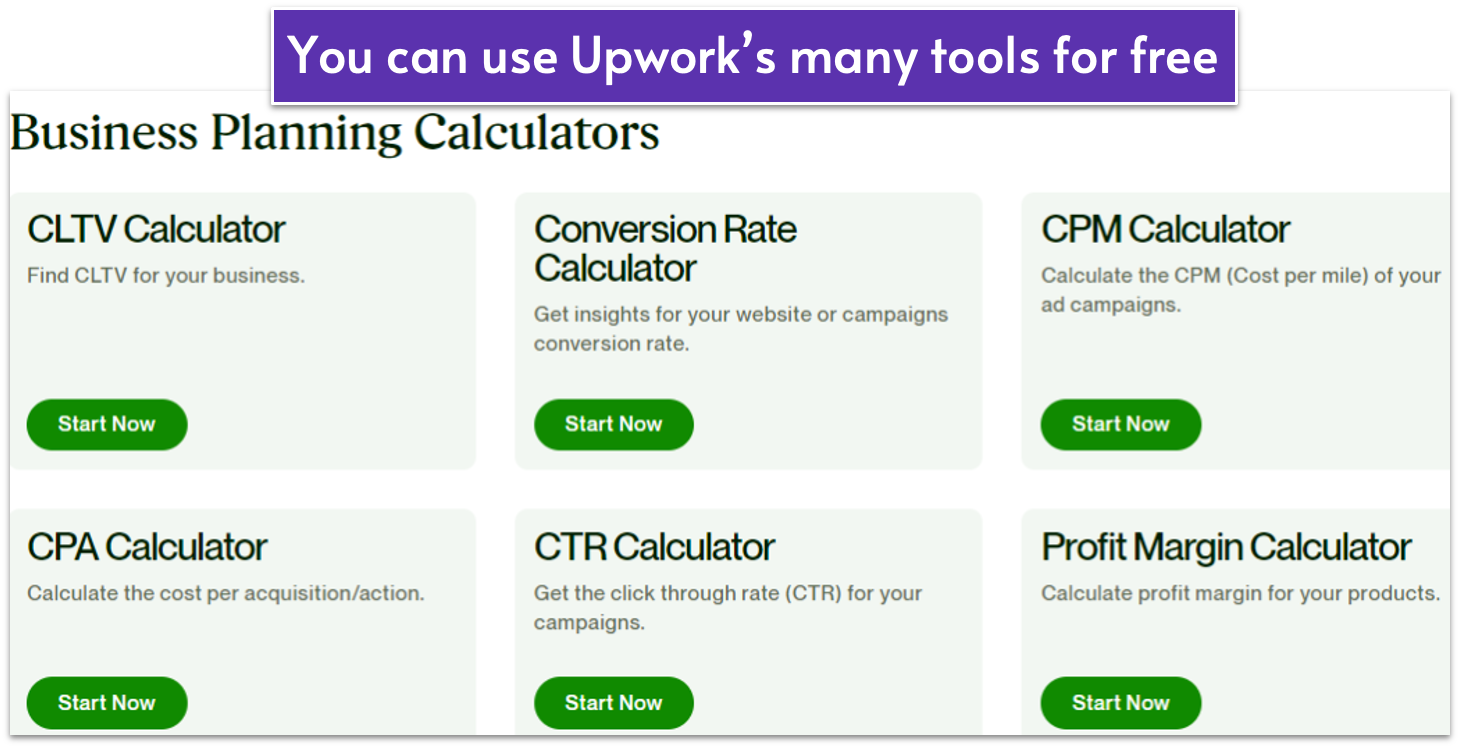

Upwork is a versatile freelance marketplace that boasts millions of active profiles. You can easily find your next favorite freelancer by either posting a job or browsing through thousands of gigs. If you have specific needs, don’t worry – freelancers on Upwork offer everything from social media marketing to generative AI modelling.Hiring, screening, and interviewing candidates has never been this easy. You can sign up and post your first job in less than 30 minutes. If you’d rather browse through the platform’s super-detailed profiles, you’ll appreciate the endless filters you can use to narrow your search. I love how you can filter results based on freelancers’ Job Success Score.

Millions of freelancers are available for hire, and Upwork makes it easy to connect with them. With the click of a button, you can initiate chats, schedule video meetings, exchange files, and even monitor work by keeping an eye on work diaries.

You don’t even need an Upwork account to hire a freelancer. Through the Direct Contracts program, you can set the terms directly with your chosen freelancer. You send your payment to Upwork for safekeeping and pay by credit card, PayPal, or ACH bank transfer if you’re in the U.S.

Upwork’s Payment Protection plan adds an extra layer of security. For hourly gigs, freelancers track their time in their Work Diary, which you can view. For fixed-price jobs, money is held by Upwork until project milestones are hit. Since payment isn’t released until you approve the work, freelancers are encouraged to deliver precisely what they’ve promised.

Top freelance categories: Writing, graphic design, software development, IT support, and data science

-

![copy-of-category-page---best-freelance-websites-to-hire-great-freelancers-3.png]()

- Extremely rigorous screening process

- Best choice for niche freelancers

- Talent hand-selected for you by experts

- Two-week trial period with each freelancer

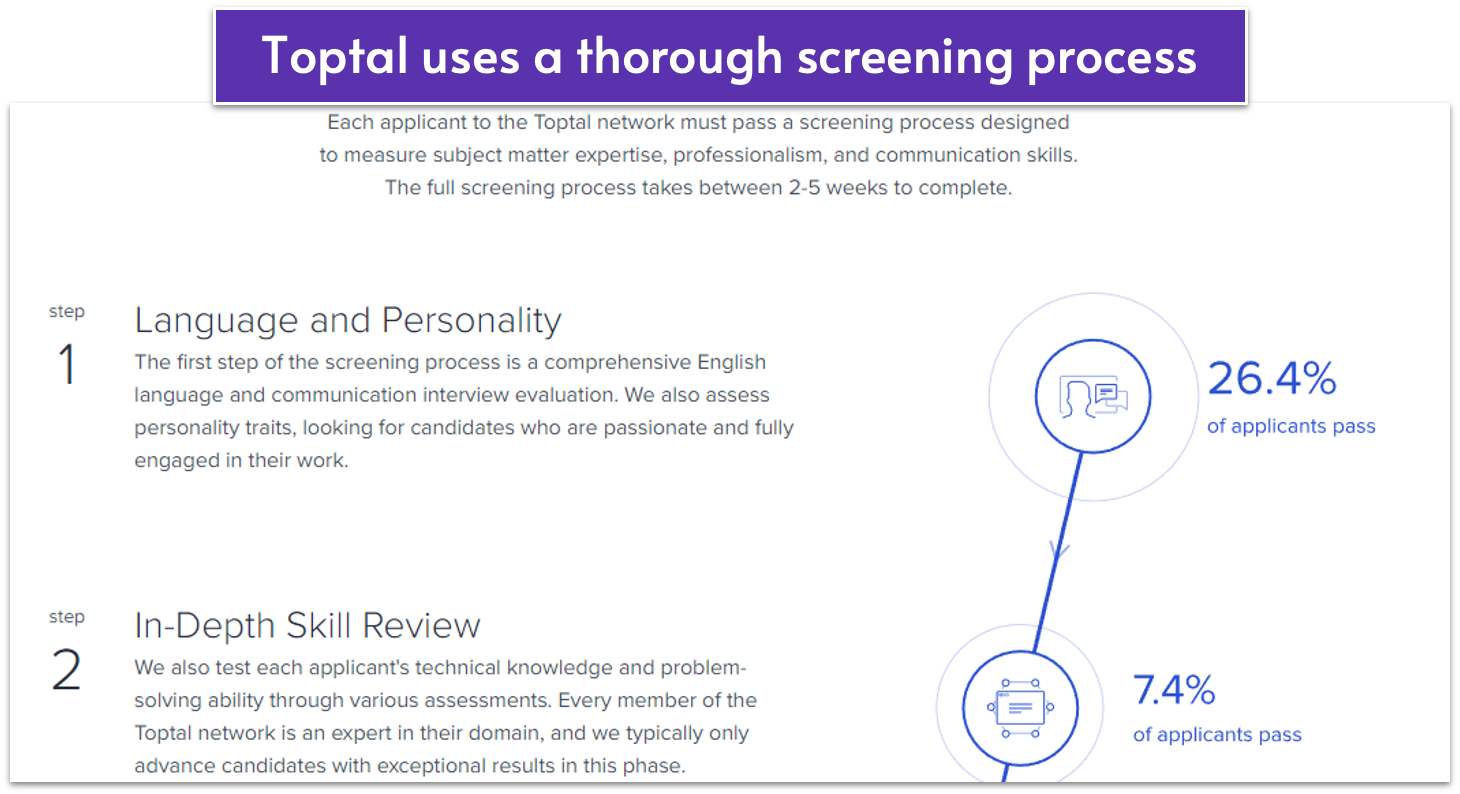

Toptal pitches itself as a global network of world-class talent. Of the 100,000 or so people who apply each year to join Toptal as freelancers, Toptal claims that only 3% are selected. And although Toptal only has five main freelancer categories – designers, developers, finance experts, product managers, and project managers – each category is broken down further.

If you click through to see the skills directory, you’ll find more than 200 types of developers alone. For example, developers can range from front-end developers to specialists in machine learning and blockchain technology. Similarly, design roles include UX, UI, and animators. This makes Toptal the best choice for niche freelancers.

I was impressed to see so many freelancers with top-of-the-line references, including people who used to work for companies like Apple, Facebook, and SpaceX. Many freelancers are also alumni of prestigious universities, both American and international.

There’s a rigorous five-step screening process that can take up to five weeks to complete. If a freelancer doesn’t make it through round one, they are disqualified from Toptal. So you know you’re getting the best.

Every time you start working with a new freelancer, Toptal gives you a trial period of up to two weeks to decide whether it’s a successful match for you. If you’re not completely satisfied, you won’t be billed for the time, and you can move on to the next match.

Top freelance categories: Software developers, designers, finance experts, product managers and project managers

-

![copy-of-category-page---best-freelance-websites-to-hire-great-freelancers-4.png]()

- High-quality, pre-vetted talent

- Simplified hiring process

- Ability to build whole teams

- Easy to replace freelancers for free

GrowTal focuses on providing top-level marketing services to agencies and growing businesses.

Each freelancer on the platform undergoes a meticulous selection process, ensuring that you only work with professionals who have a proven track record of success. GrowTal’s team of experts will help you find the perfect match for your project by understanding your requirements, goals, and budget.

GrowTal’s pool of marketing experts includes SEO consultants, UX designers, and content marketers – just to name a few. Projects are delivered on time, and you can even build custom freelance teams to tackle more complex tasks.

The catch is that you’ll likely need to pay a bit more than you would on other popular freelance websites, such as Fiverr and Upwork. You also pay a $500 deposit fee to join the platform, which might put GrowTal out of reach for the average marketer.

However, you don’t need to worry. You start with a free 30-minute chat to connect with one of GrowTal’s skilled marketers. If you find someone you click with and want to take things further, then you have to pay the deposit. And, if things don’t pan out, that deposit comes right back to you.

Top freelance categories: Digital marketing, content marketing, SEO, social media, and growth hacking

-

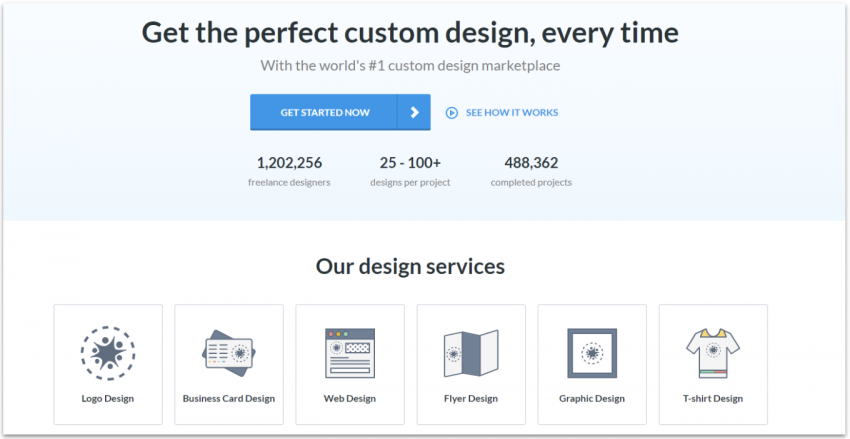

![copy-of-category-page---best-freelance-websites-to-hire-great-freelancers-5.png]()

- Great for one-off projects for small businesses

- Offers a wide range of design types

- 60-day money-back guarantee

- Excellent support

With over 1,200,000 designers on DesignCrowd, you’re bound to find one who matches your style. To get started, you select a package based on the number of submissions you want, and then post a brief for three to 10 days. DesignCrowd’s affordable prices make it, it’s a great fit for smaller businesses with occasional design needs. Plus, there is a wide range of design types, from business cards to web design.

The process for DesignCrowd is similar to 99designs, but cheaper and less in-depth. Your brief is only one page, and you miss out on features like designer reviews and their job success rate. If you’re on a budget, I’d call it a worthy trade-off though.

I like how you can either work with a designer one-on-one, or run a contest and review submitted designs. Once you choose your favorite design, you can provide feedback and ask for free unlimited revisions.

Top freelance categories: Graphic design projects including logos, web design, and print projects

-

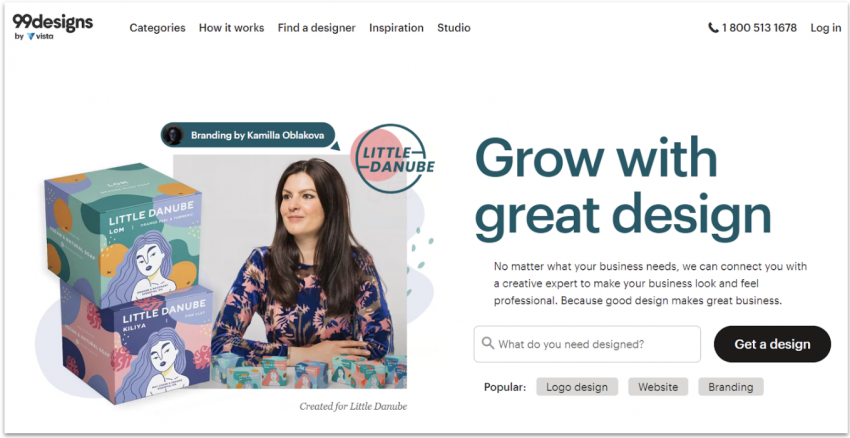

![copy-of-category-page---best-freelance-websites-to-hire-great-freelancers-6.png]()

- Best platform to get a reliable yet affordable designer

- Wide range of design types available

- Design contests let you pick from multiple options

- Option to select a designer to work with

99designs works in two ways – you can search for a designer to hire for your project, or you can launch a contest. When I ran a contest for a design project, I quickly found the designer I wanted based on the quality of entries I received.

99designs certainly isn’t the cheapest (nor is it the most expensive), but you’re guaranteed to get a good designer on board. The contest feature especially helps you find the right match, as you’ll have more options to choose from.

99designs is easy to use, and I was very impressed with the designers on the site. It was super simple to set up a contest, and I loved how it asked preliminary questions to help learn my style. This helps designers understand the kind of logo you want, which is great for non-design experts.

You pay for your project upfront, and once you approve the design, the money is paid to your designer. You then own all the rights to your design and receive project files for print and digital. When I ran into a slight issue with my contest, support was very responsive and helped resolve my problem in no time.

Top freelance categories: Design projects ranging from logos to clothing designs

-

![copy-of-category-page---best-freelance-websites-to-hire-great-freelancers-7.png]()

- Extensive briefing and clever AI matching

- 600+ hand-vetted experts

- Dedicated success manager

- Campaign monitoring through your dashboard

Mayple is a compelling option if you’re ready to invest in comprehensive, high-end marketing solutions. It’s more akin to a digital marketing agency than a freelance platform, providing a hands-off approach while maintaining quality control.

A key feature of Mayple is its AI algorithm that matches you with suitable marketing professionals based on detailed briefs about your objectives, challenges, and revenue goals. This initial process, although extensive, ensures a highly tailored service. The platform covers various marketing disciplines, from SEO to social media, catering to diverse business needs.

Mayple can get expensive, making it less appealing if you’re a small business looking for cost-effective, short-term solutions. That said, pricing is transparent, with packages for various marketing needs and budgets.

Mayple will assign you a dedicated manager to ensure close monitoring of marketing campaigns and provide an additional layer of quality assurance. This feature, not commonly found in other freelance platforms, adds extra value and, as expected, contributes to the overall cost.

Top freelance categories: Email marketing, SEO, social media, influence marketing, and paid advertising

-

![copy-of-category-page---best-freelance-websites-to-hire-great-freelancers-8.png]()

- Posting requests on Bark is 100% free

- Freelancers pay to contact you

- Thousands of detailed profiles in many countries

- Average market rates

Bark is an excellent option if you want to hire locally. You can post job requests and get matched with professionals, including agencies and small companies. Bark’s model is unique because it charges professionals a fee to contact you, which could mean fewer but more personalized offers for your job postings.

Posting requests is easy – and so is filtering matches based on ratings and response times. Detailed profiles provide insights into the professionals’ history and services, but you do need to contact freelancers for a custom quote each time.

Bark doesn’t handle transactions directly. This approach puts the onus on you to negotiate rates and handle payments without transactional security or refunds. That said, the prices quoted on the platform are generally reasonable and close to the average market rate.

Bark can complement job boards like Indeed or LinkedIn, especially for local services. The platform strikes a good balance between cost and quality of work. However, you should exercise caution and due diligence when hiring, as Bark doesn’t vet professionals.

Top freelance categories: Web design, accounting, counseling, house cleaning, and music gigs

Thinking About Hiring a Freelancer?

Why Are More Companies Hiring Freelancers?

Thanks to technology, remote work is often as seamless as working in-house, so many businesses are turning to freelancers even more. And it’s not just giant companies, but businesses of all sizes – startups, small businesses, and even micro businesses. Solopreneurs, such as bloggers, speakers, and coaches, also find freelancers help them get things done so they can focus on their strengths. Using freelancers is on the rise for the following reasons:- Frees up more time. There are many tasks that only you and your team can do. By outsourcing jobs that can be done just as well (or even better) by a freelancer, you can build stronger relationships with your customers and come up with awesome new ideas.

- Specialized skills. If you’re working on a white paper for a new target audience, it’s possible that your team doesn’t include an expert on the topic. But you can find a freelancer with lots of experience in beekeeping, artificial intelligence, or quantum computing – whatever your project needs.

- Lower costs. With full-time employees, you pay for benefits, training, equipment, and vacation time. With freelancers, you simply pay for the services they provide.

- Flexibility. When you hire a full-time employee, you pay them regardless of the amount of work you have for them to complete. With a freelancer, you can hire them for whatever amount of work you need. You can do a single project, a set number of hours per week, or a retainer for ongoing projects.

- Remote work. Got a small office? Physical space costs money. Freelancers typically work remotely, meaning you don’t need a desk for them at your location.

- Less commitment. If you hire a full-time employee, it can be challenging if it’s not the ideal fit. Typically, there’s a process for performance improvement, probation, and possibly severance costs for letting the employee go. With a freelancer, you face a lot less risk – if they aren’t a fit, you simply don’t hire them again.

What Are the Most Searched-for Freelance Jobs?

Not surprisingly, the most common freelance jobs are writing, graphic design, and website development. However, there are many categories within those fields. All writing is not equal – a fabulous marketing copywriter probably can’t handle your technical writing project. And a website developer might not be the best person to hire for a hardcore coding project.What You Need To Know Before Hiring a Freelancer

You want to hire someone online but don’t know where to start. You’re thinking:- What are the best freelance websites?

- How much will I have to pay?

- What if my freelancer doesn’t deliver?

- What’s the job? Finding the right freelancer is easier when you clearly understand what you need. What are your expectations? Can you describe the task in one sentence? Don’t be the person who commissions a logo redesign but ends up asking for a complete brand overhaul.

- What skills does the freelancer need? Do they need to know how to use certain tools, like Word, Excel, or WordPress? Should they have experience in specific industries? Are there any other traits they need to have, such as creativity or being detail-oriented?

- What resources do they need? Freelancers provide the best results when they have a sample to use for their work. Share examples to give them a starting point. Do you have documentation, presentations, or emails that can provide useful background information? Will the freelancer need to speak with any experts at your company to get information?

- Who will be the contact person? Please assign an individual to facilitate the freelancer’s onboarding, address inquiries, and oversee the project. The effectiveness of the project hinges on the contact person’s capacity to offer necessary assistance and respond to the freelancer’s requirements.

- What is the review process? Your freelancer likely won’t hit exactly what you want the first time. You need to determine who will review the project, how they will provide feedback, and who has final sign-off authority. The more organized the process, the better the chance of a high-quality project.

- What is the schedule? Freelancers are accustomed to working with deadlines, and they appreciate clear instructions on when they should deliver their work. Make sure to allocate time to review and make revisions. Include a buffer of a few extra days to account for unforeseen delays, which are almost inevitable.

When Should You Use a Website To Hire Freelancers?

You can’t really go wrong by hiring people through reputable freelance websites such as Fiverr or Upwork. It’s safe, fast, and cost-efficient. If you’re a freelancer yourself or run a small business, hiring someone online to complete small tasks will save you time and money. These websites often charge a small service fee, but to offset that, they offer work and management tools that simplify processes. Hiring someone directly might be the more sensible choice if you run a bigger business. The small fees I mentioned above stack quickly as you scale up your projects. Still, as a recruiter or manager of a larger company, you should consider hiring a freelancer online if:- You don’t know where to look. Let’s say your company isn’t already using freelancers in that industry, and you have no referrals to turn to.

- It’s a small job. For example, hiring a website designer directly to create a logo for your company can cost you hundreds of dollars. A Pro-verified expert on Fiverr can deliver similar results for less than $50.

- You’re out of time. On popular platforms like Fiverr and Upwork, you can easily find and hire people in less than an hour.

- You’re on a tight budget. Service charges aren’t important if you use a freelance website and pay half the usual rate. Platforms also offer freelancers in all price brackets, making it simpler to find one that suits your budget.

- You don’t have a contract and payment process already set up. On top platforms, you also have protection (and available arbitration) against lower-quality work (because freelancers agree to these terms to use the platform).

How To Choose the Best Website To Hire Freelancers Online

There’s no shortage of freelance websites. As you can probably tell, hiring someone hastily on the first site you find is probably not a good idea – why waste time and money on subpar services? We’ve examined all the top freelance platforms and used our insights to compile our list. We regularly update our entries as new features are introduced and new contenders enter the scene. Over the years, we learned that one-size-fits-all approaches don’t work, so we take the time to look at each service from multiple angles. That doesn’t mean we don’t have favorites.Fiverr Is Our Go-To for Short-Term Hiring

- Managers running projects with tight deadlines

- Small and medium-sized businesses on a budget

- Anyone new to online freelance platforms

Upwork Is Our Go-to for Long-Term Hiring

- Businesses looking for long-term hires

- Anyone looking for collaborators to help with bigger projects

- Managers looking for tools to streamline hiring procedures

Toptal Features Vetted Experts Across Niches

- Businesses looking for the best designers, software developers, finance experts, and project managers

- Anyone prepared to pay a premium for premium services

How Much Does It Cost To Use a Freelance Platform?

Each freelance site has slightly different costs, and it’s important to calculate the fees before signing up. Most of the sites use one of the following models or a combination:- Percentage. With this model, you pay a set percentage, usually ranging from 2% to 5% of the overall fee. If you have sporadic freelancing needs, a percentage may be the most cost-effective payment route for you.

- One-time fee. This structure gives you set features and privileges, such as a certain number of searches or types of hires per month. This works best for companies with a higher volume.

- Premium memberships. Many sites offer premium add-ons or services that either give you access to highly rated freelancers or select freelancers for you. Their cost and fee structures vary.

| Fee to Post | Service Fee | Premium Services | ||

|---|---|---|---|---|

| Fiverr | Free | 5.5% of the purchase + $3 if the order is below $100 | Fiverr Pro freelancers have higher rates, but the percentage is still 5.5% | |

| Upwork | Free | 5% | Business Plus plan (10% fee, a discounted fee of 8% for eligible clients in the U.S. who pay with a checking account) | |

| Toptal | Initial $500 deposit, applied as credit to your first invoice | None | None | |

| Growtal | Refundable $500 deposit | 30% | Several bundles starting from $299 | |

| DesignCrowd | Fixed price based on contest, starts at $99 | 4% | None | |

| 99Designs | Fixed price based on contest package; starts at $299 for logos | None | None | |

| Mayple | Packages start at $1,800/month | None | Consultations and expert advice available as extras | |

| Bark | Free | No fees for clients, freelancers pay to contact you | None |

How Do I Hire a Freelancer?

Once you find a freelancer you think you’d like to work with, the process is just beginning. A freelancer is much more than a profile. You need to make sure that you are a match beyond just their resume. While you might be tempted to find a freelancer on a site and then hire them directly off the platform to save money, doing so is against the policy of many hiring sites. And with some sites (like Upwork), you can face penalties and/or get banned from the site. Since the platforms provide a useful and valuable service, staying on the platform is the ethical way to work. Once you find a freelancer who looks like a good fit, it’s time to:- Communicate with the freelancer. All the platforms we reviewed have a messaging system that lets you communicate with a freelancer before you hire.

- Check availability. If you have a quick turnaround time, you need to see if they can fit your project on their calendar. And if you have ongoing needs, make sure the freelancer has the available hours.

- Talk about the project and your expectations. Go back to where you clearly defined what you need and share that information with the writer. Talk about what your ideal results would be, as well as what you expect along the way, such as check-ins and milestone delivery.

- Have the freelancer take a test. While this isn’t a fit for all projects or freelancers, many platforms offer this option.

Getting the Most Out of Your Freelancer Relationship

Yes, picking the right freelancer is an essential part of the process. But that in itself might not be enough. The best relationships (and results) come when both the business and the freelancer view the project as a partnership. A freelancer can’t read your mind. They don’t know exactly what you want or how your business works. You must provide the resources they need, be willing to answer questions, and provide constructive feedback. Yes, it’s up to your freelancer to create quality results. But that will only happen if you put the time and effort into the project.FAQ

Which platform is best for hiring freelancers?

It all depends on your individual needs. For smaller projects and one-off tasks, our go-to hiring platform is Fiverr. It’s affordable and easy to use, and there’s also an option to work only with Pro-Verified freelancers.Is Fiverr better than Upwork?

Generally, a Fiverr freelancer will charge less than a freelancer on Upwork for work of similar quality. That said, we prefer Upwork for larger projects and long-term contracts. It’s designed more as a digital workplace and less like a marketplace, with plenty of work-related tools (e.g., for interviewing, keeping track of time, and calculating costs).Which is better, Fiverr or Freelancer.com?

It depends on the job at hand. They’re both great at what they do, but Fiverr offers a broader range of services at better prices. It’s worth performing a search on both websites before making your choice.Does Fiverr take a fee?

Yes, Fiverr charges a service fee. When purchasing a package, buyers will pay a 5.5% fee and an additional small order fee of $3 for orders below $100. This fee helps cover payment processing and platform maintenance costs.Which websites for hiring freelancers offer the best payment protection?

Upwork has a reliable escrow system – they hold your payment until project milestones are completed. Freelancers are paid upon delivery, ensuring both sides are secure. Fiverr functions similarly, while Toptal works directly with you on billing and invoicing, offering personalized support.Which websites for hiring freelancers are the best for ongoing work?

Upwork allows you to hire freelancers on an hourly or long-term contract basis, making it an excellent fit for dynamic projects. Fiverr is more geared towards fixed-price packages, but many categories offer the subscription model, which lets you work with your favorite freelancers for up to six months.- Fiverr

- Upwork

- Toptal

- GrowTal

- DesignCrowd

- 99designs

- Mayple

- Bark

- Thinking About Hiring a Freelancer?

- Why Are More Companies Hiring Freelancers?

- What Are the Most Searched-for Freelance Jobs?

- What You Need To Know Before Hiring a Freelancer

- When Should You Use a Website To Hire Freelancers?

- How To Choose the Best Website To Hire Freelancers Online

- How Much Does It Cost To Use a Freelance Platform?

- How Do I Hire a Freelancer?

- FAQ

So happy you liked it!

We check all comments within 48 hours to make sure they're from real users like you. In the meantime, you can share your comment with others to let more people know what you think.

Once a month you will receive interesting, insightful tips, tricks, and advice to improve your website performance and reach your digital marketing goals!