Inside this Article

Square may not be perfect, but it’s true to its word – you can delete your account easily. The process was completely hassle-free, even though I had signed up for the base plan.

Square is a good payment processor to try out, particularly if you’re a new or small business with a low budget and can’t afford monthly fees. Not only is it easy to sign up for, but you’ll get plenty of POS, e-commerce, and business management software to support your growth.

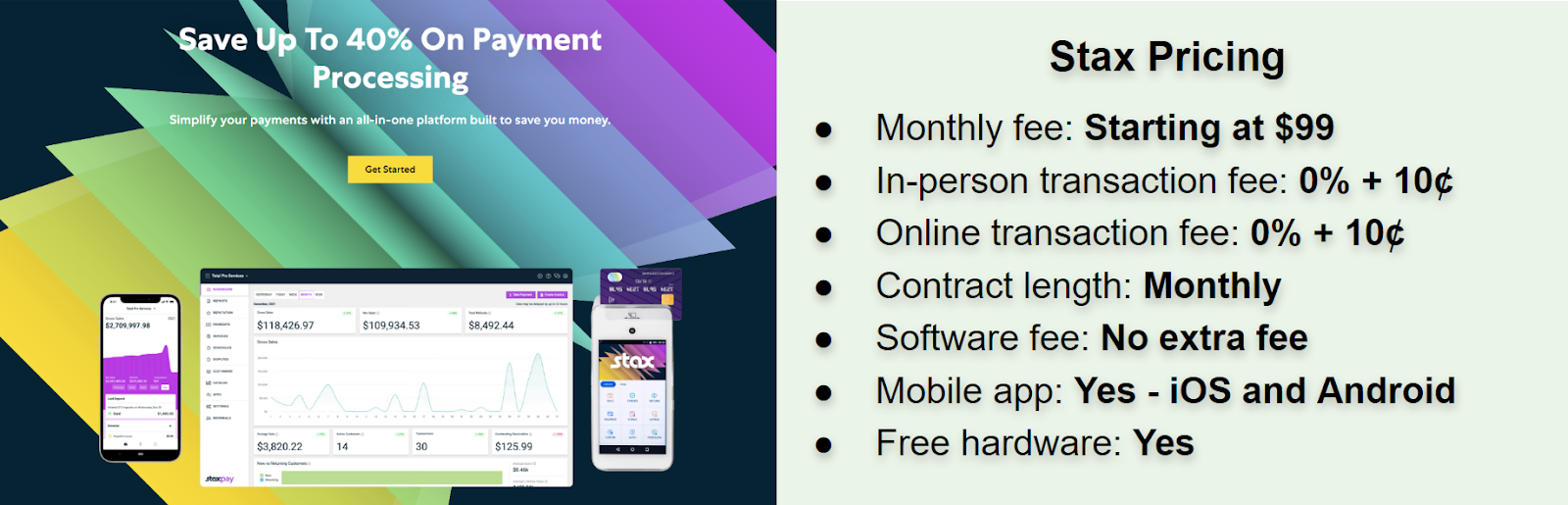

That said, it’s not the best choice for every business. You might feel held back by the lack of support. Or your business may have simply outgrown Square’s higher-than-average interchange-plus fees. In this case, you’ll find you can save a lot of money with Stax, which also includes plenty of software options.

Fortunately, deleting your Square account is easy, and it doesn’t require lengthy calls to customer support, either. You can check out our recommended alternatives and start using the new processor before making the switch so you won’t lose any sales.

Quick Guide: How To Cancel Square

Before deleting your Square account, you should download some key records. This is to ensure a) a smooth transfer to a new payment processor and b) that you have all the documentation you need for legal purposes. Here’s what you need to do:

1. Log in. Go to the Square homepage and log into your dashboard.

2. Transfer any available funds. If you’re using a Square Checking account, you’ll need to close it. Navigate to Balance > Locations, and then click the gear icon. From there, select Square Checking > I’d like to close my account and deactivate your Square Debit cards.

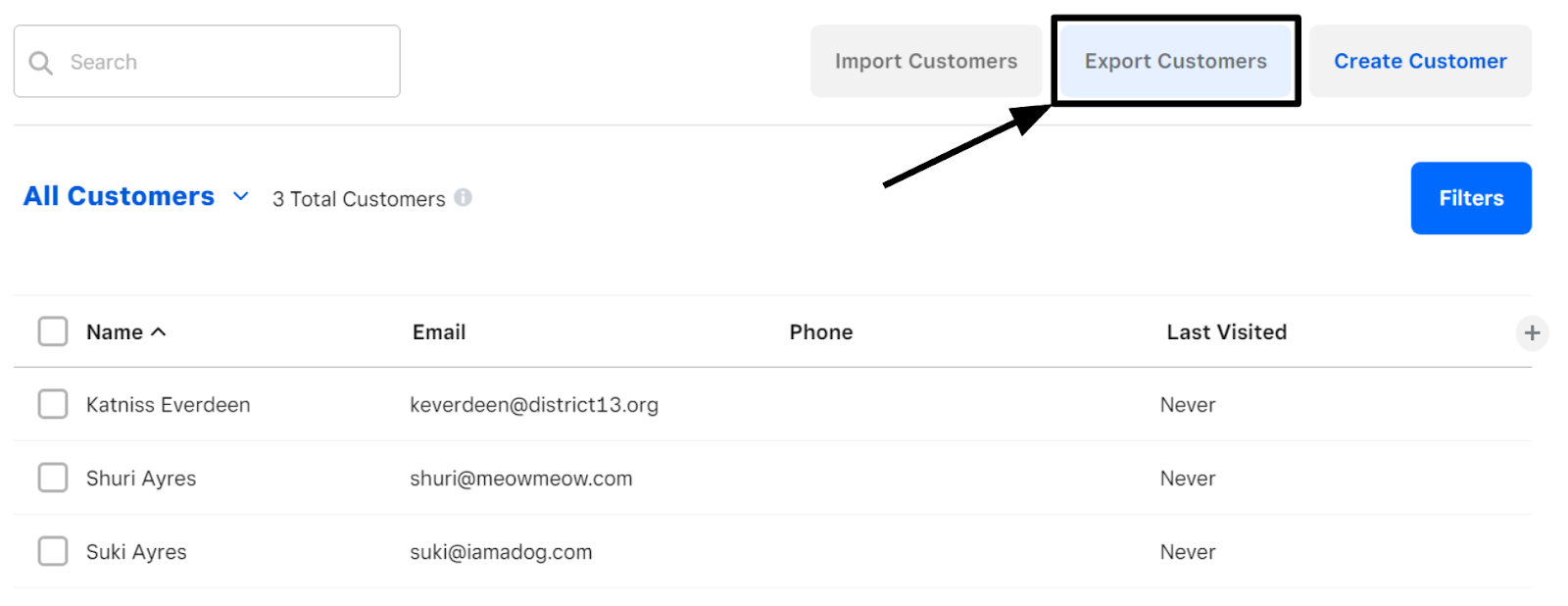

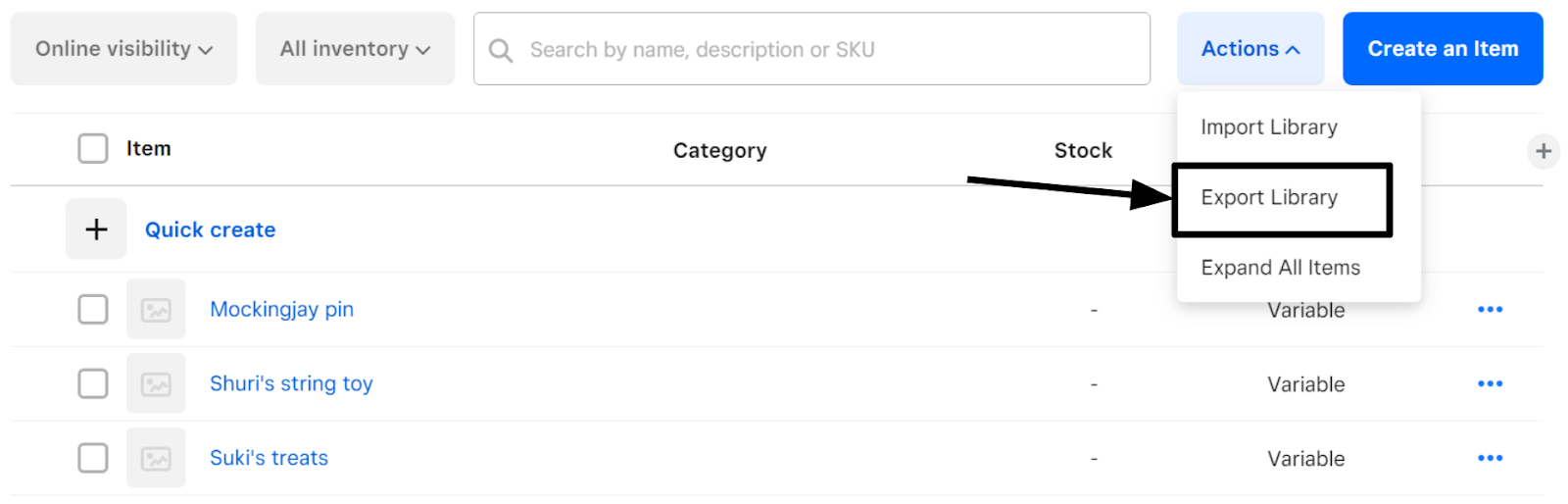

3. Export all information. Go into each section on your menu and click the Export button (this may be part of an Actions dropdown menu on some pages).

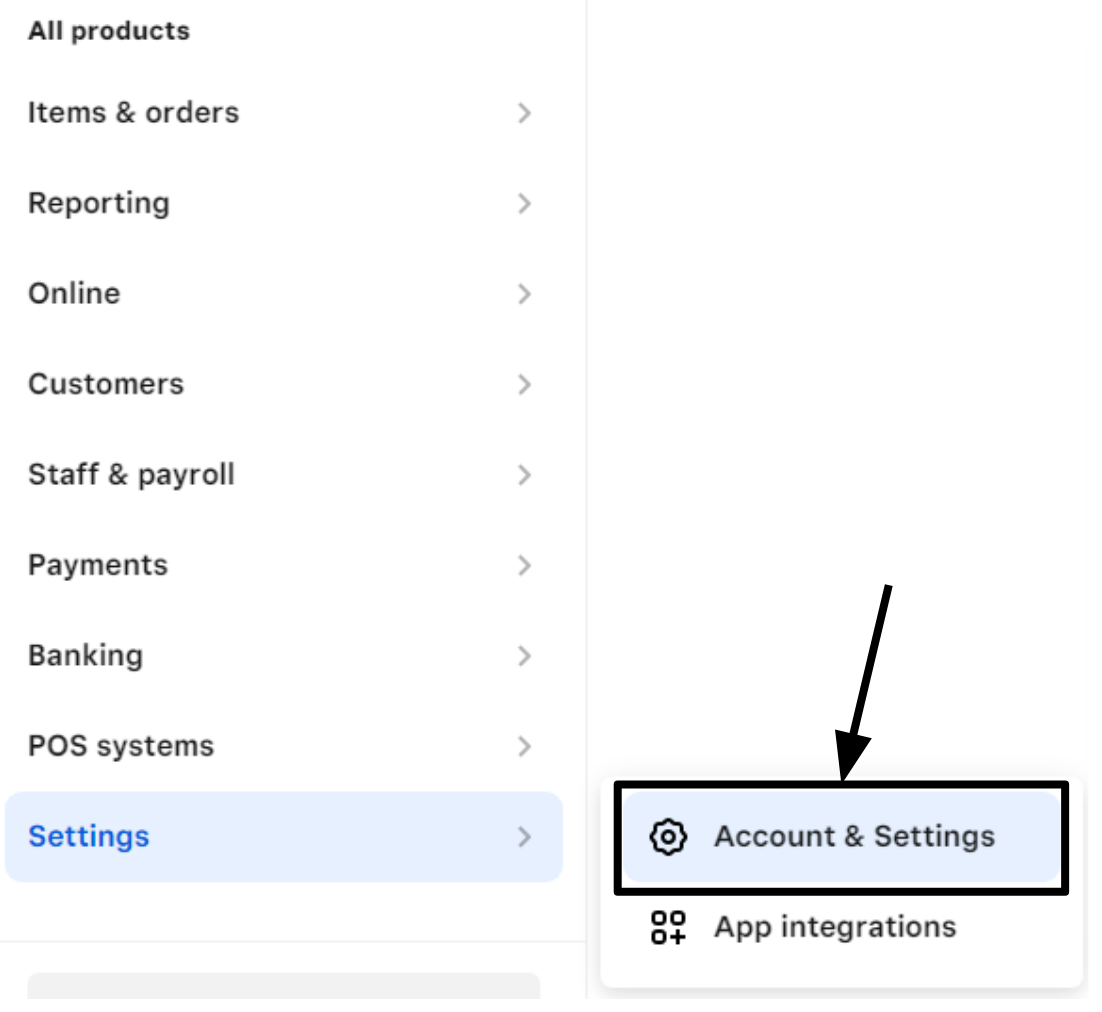

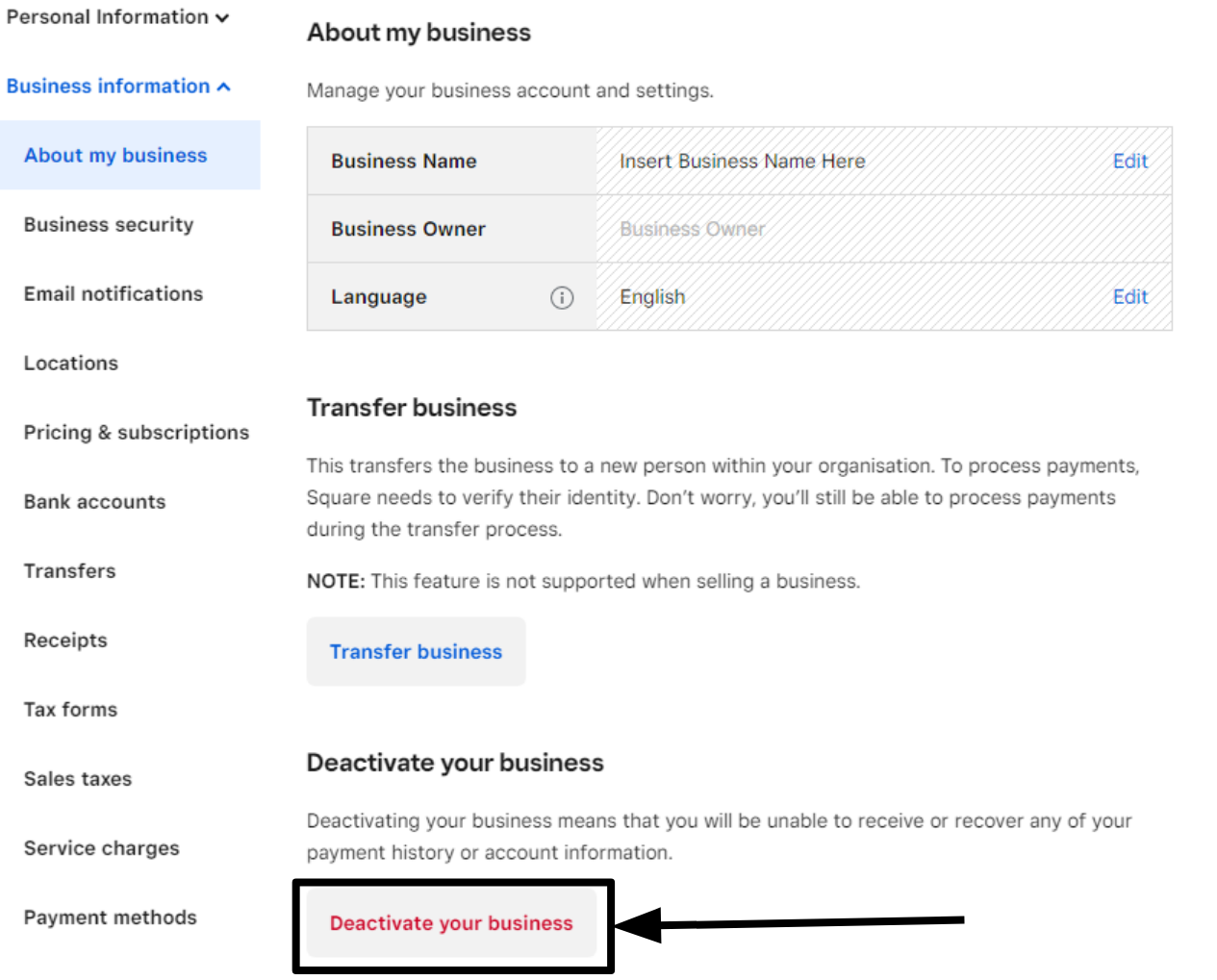

4. Close your Square account. Navigate to Account & Settings > Business information > About my business > Deactivate business. Provide your reason for deactivating your account, click Continue, and enter your 2-step verification code or password.

Caution: Before You Delete Your Square Account

Make sure you have measures in place to deal with legacy transactions. A legacy transaction typically refers to any transaction processed before the merchant opened an account with the current processor. You are responsible for resolving refunds, chargebacks, or other disputes arising from previous Square transactions, even after you have deleted your account. However, you won’t be able to use Square to issue any owed money or dispute chargebacks.

Because of this, I recommend you check your new processor’s terms of service to see if you can handle these issues through its infrastructure. Not every processor allows for this. However, because Square doesn’t charge any ongoing fees, you can keep your account open until the risk of transactional issues has passed.

My Experience: Here’s How I Canceled My Square Account

Square is one of the few payment processors that doesn’t lock you into a contract or charge any termination fees, so deactivating your Square account is easy. But there are a few things you’ll need to do before deleting your account. You should export as much information as possible, particularly financial information and any available tax forms. You can’t recover this information once you’ve deleted your account.1. Log In to Your Square Account

First, go to the Square homepage and sign into your account to see your dashboard. Unlike other payment processors I’ve reviewed, you can deactivate your account in your dashboard without contacting customer support.

2. Transfer Available Funds (And, if Applicable, Your Square Checking Account)

When transferring from any payment processor, I always recommend having a new solution in place, so you don’t have to worry about incoming funds hitting the wrong account. However, this isn’t always possible. If a payment is processed and you don’t notice it before you deactivate your account, Square will pay these funds on your previous schedule. Processed transactions will automatically be canceled. Depending on how your account is set up, you’ll receive your money regularly, so you won’t have to do anything but wait for your funds. However, if you’re using a Square Checking account, you can instantly transfer funds to your business bank account for a 1.5% fee. To do this, select Balance > Instantly Transfer and follow the instructions. Once your Square Checking account is empty, you’ll need to close it. On the desktop version of Square, navigate to Balance > Locations, and select your Square Checking account. Click the gear icon, then Square Checking > I’d like to close my account. Follow the instructions to deactivate any Square Debit cards.3. Export Your Data

The next step is to download all the data you hold in your Square account. Not only will this save you time when switching to new software, but it will also help you keep continuous financial records. You’ll want to get your 1099-K tax form from Square for legal purposes. Don’t worry if you don’t have yours yet. Square will email this to you when it’s ready, even if you delete your account. Make sure you take your time with this step. Square cannot recover deactivated accounts, so you will lose any data you haven’t exported before deleting your account. You can export your tax form by going to Account & Settings > Business information > Tax forms. Under the 1099 Tax Form header, click on any available tax forms to download them as a PDF file. Next, you’ll need to go through every option in your Square menu and export your data. In particular, I recommend exporting your customers, item list, and sales summary. If you’ve been using any of Square’s software add-ons (particularly Square Payroll), go through each to export crucial data. Depending on the page, the export button may not be immediately visible. Some, like the Customers page, have a large export button at the top of the page, like this:

4. Cancel Any Subscriptions

The last step before you deactivate your account is to cancel any active subscriptions. Fortunately, Square makes this easy too. You won’t be charged as long as you cancel your subscriptions before the next billing date. However, you won’t receive a refund for the remaining time on your subscription. Go to Account & Settings > Business information > Pricing and subscriptions. Click Manage subscription next to the active subscription. With some subscriptions, you’ll be asked if you want to downgrade. Click Unsubscribe > Confirm unsubscribe > Done. Repeat the process with the rest of your active subscriptions.5. Delete Your Square Account

Now that you’ve shut down everything associated with your Square account, I recommend considering whether you need to close your account. Even if you delete your Square account, you’re still responsible for providing refunds, managing chargeback disputes, and addressing any issues for transactions processed through Square. Square will notify you of these issues if they arise after your account’s deletion. However, it’s worth evaluating the benefits of keeping your Square account open as it doesn’t cost anything Remember that customers can file chargebacks up to 120 days after their transaction.

Here Are the Best Square Alternatives for Payment Processing

Before you delete your Square account, I recommend setting up a new merchant account so you don’t miss any sales. I’ve been researching payment processors for months, so I’ve compiled this list of the best Square alternatives to help you find the best option. Whether you need more affordable pricing, better customer support, or just a new payment processor with similarly great software, these alternatives have much to offer.

1. Stax

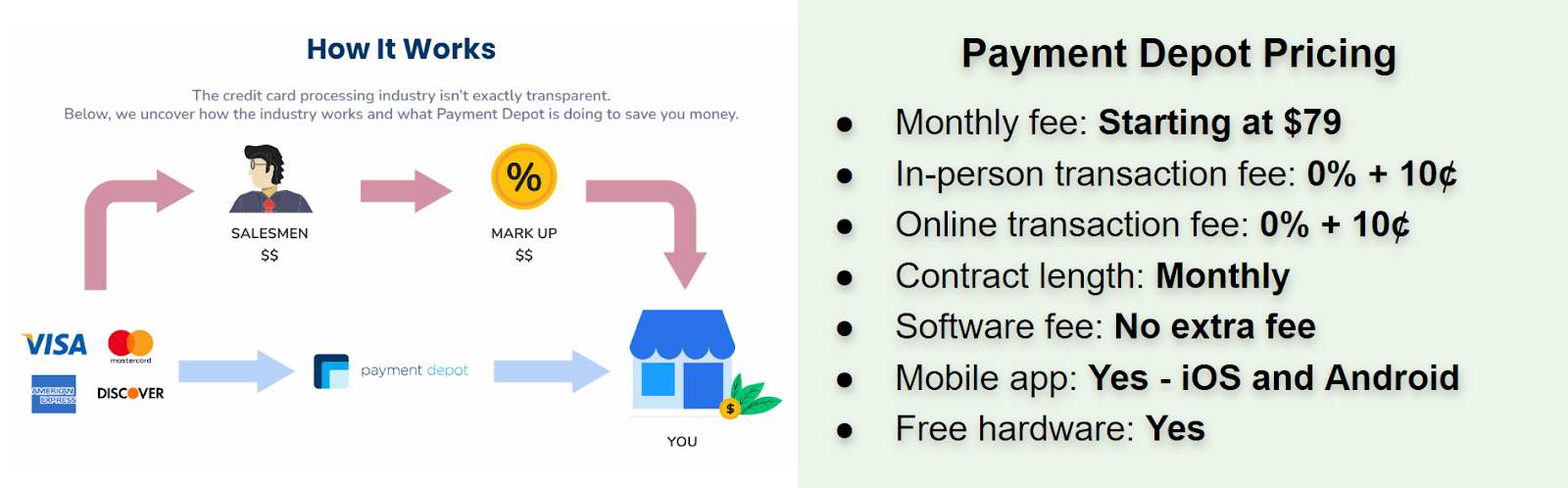

2. Payment Depot

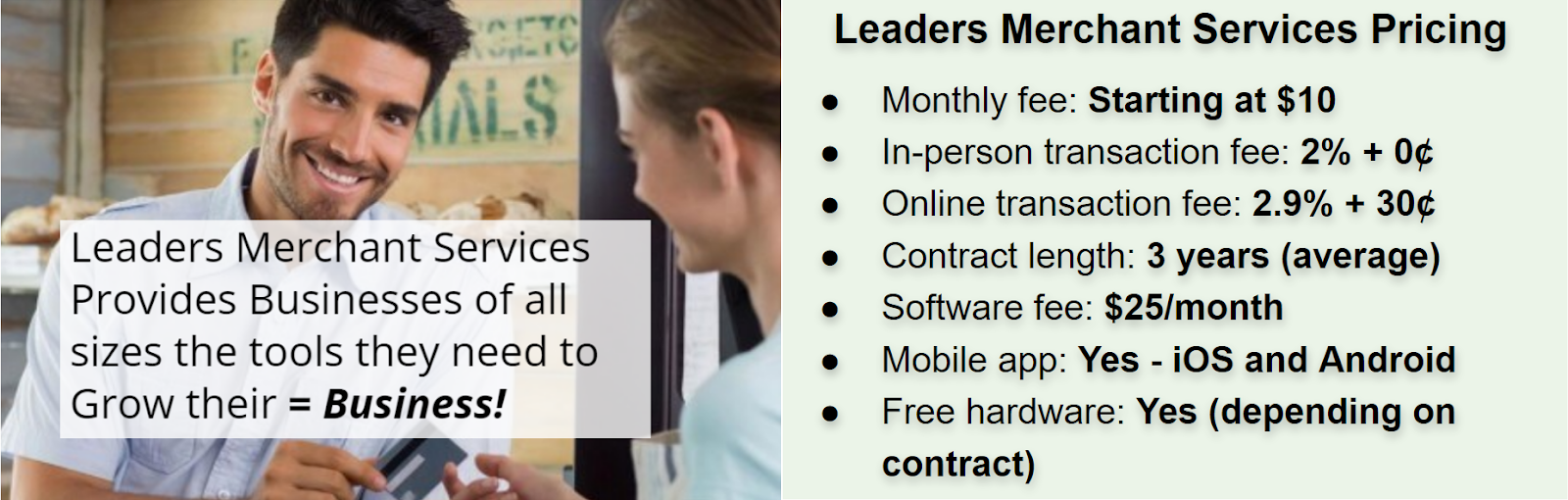

3. Leaders Merchant Services

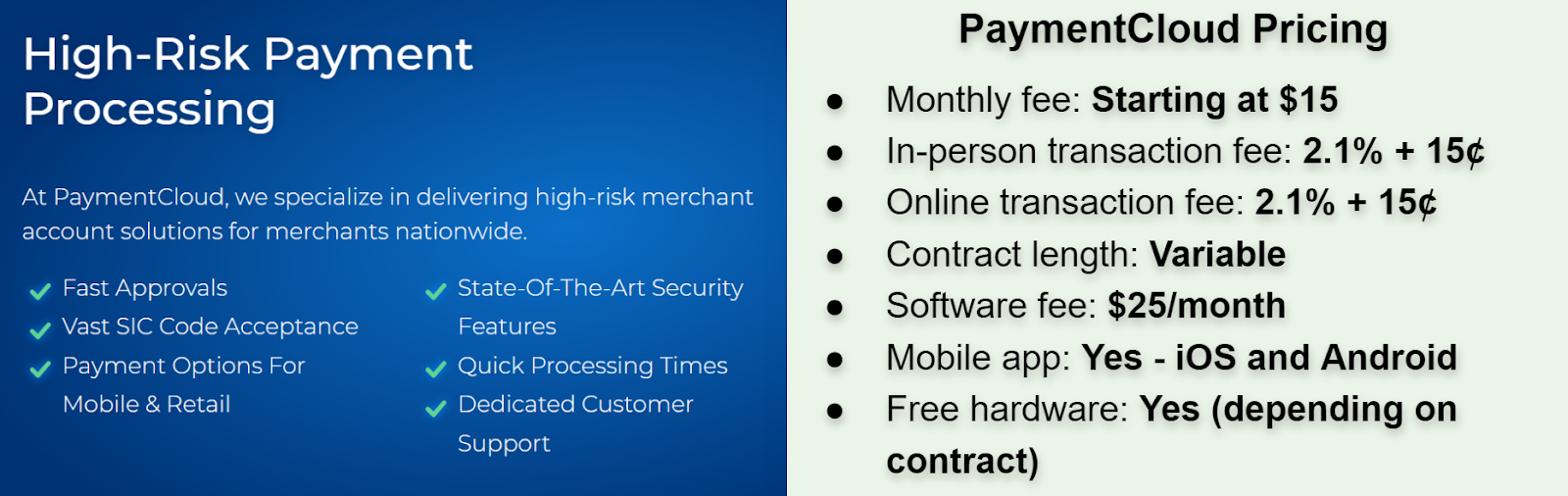

4. PaymentCloud

Unsure which processor is best for your business?

Take this short quiz and get a tailor-made recommendation in seconds