Chase Payment Solutions℠ Feature Summary

| POS equipment | 5 POS devices available to purchase |

| Payments methods accepted | Credit and debit cards, digital wallets, ACH |

| Payout times | Same day if you deposit into a Chase business account, next day if you deposit into a third-party account |

| Contract length | Monthly (no cancellation fees) or variable (cancellation fees may apply) |

| Customer support | 24/7 phone support line |

| Security | PCI-compliant, tokenization, end-to-end encryption, advanced fraud detection and prevention, payer verification |

Quick Payouts… but Mixed Reviews

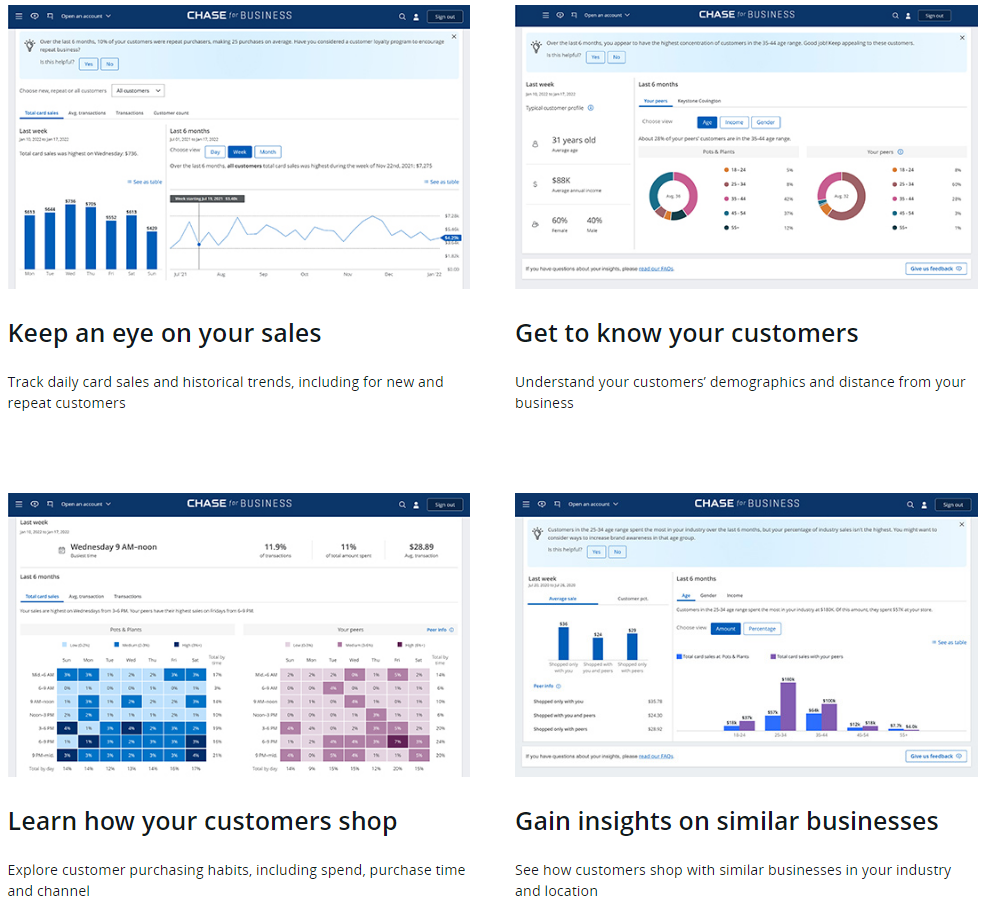

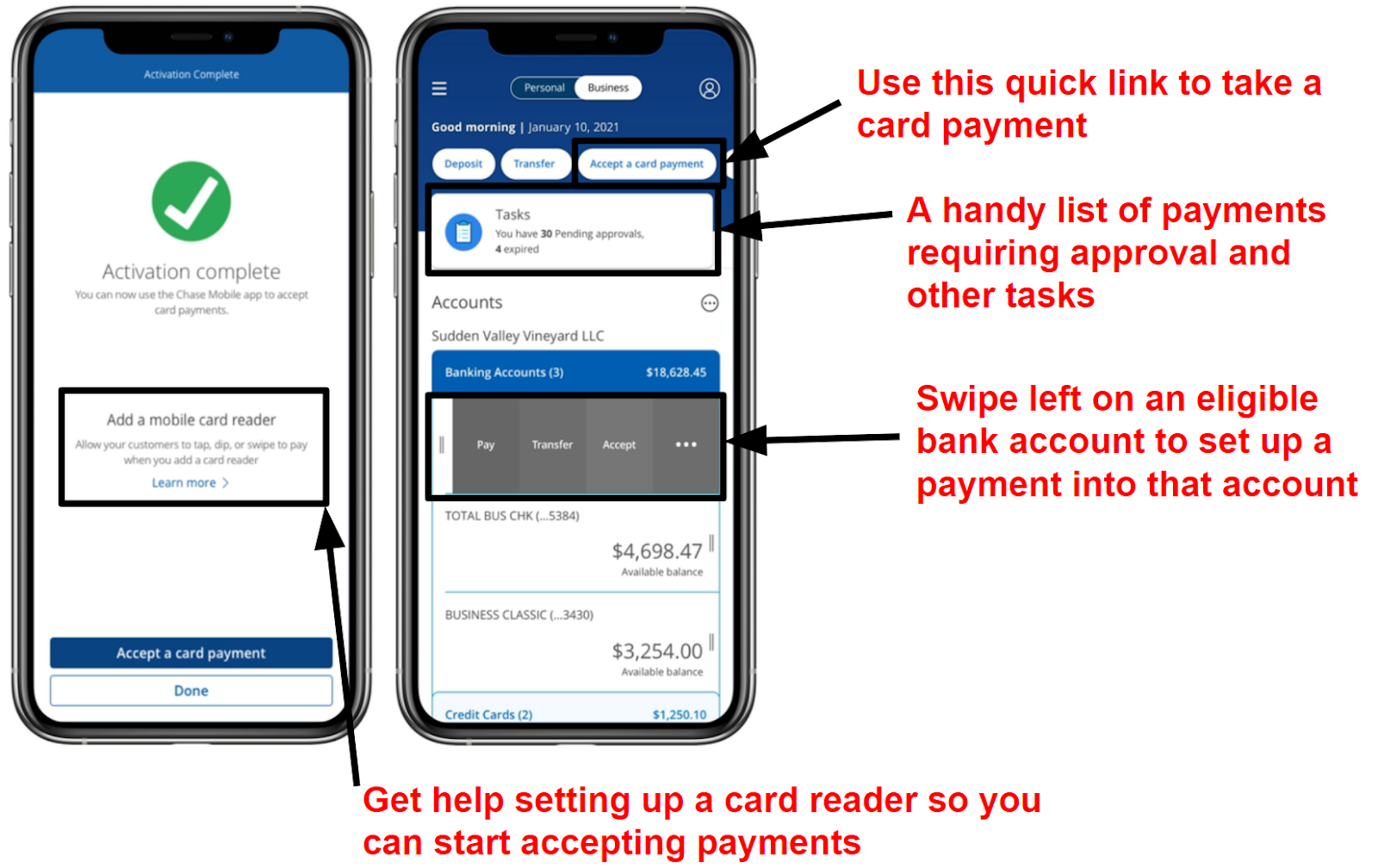

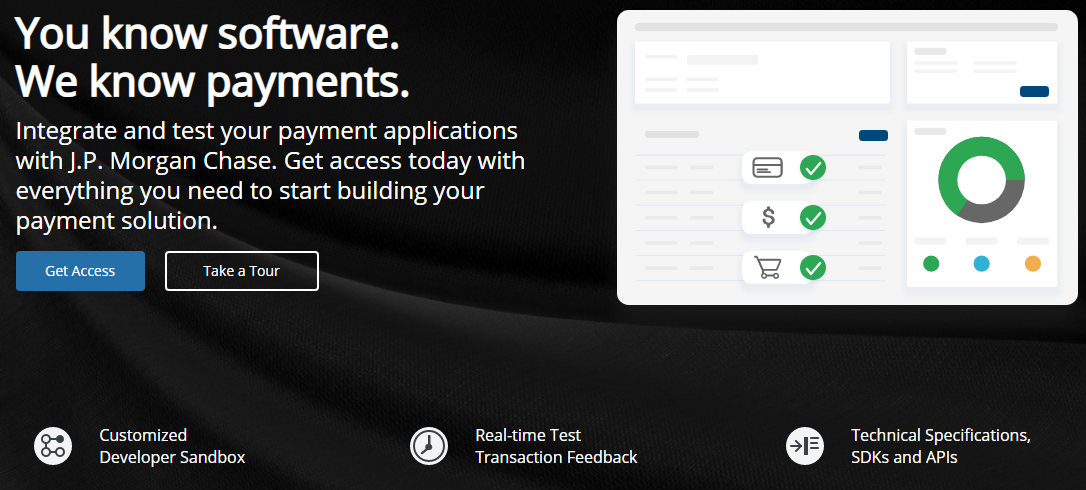

Chase Payment Solutions℠ (Chase for short) is one of the largest payment processors in the world, with over 5 million customers across the US and Canada. It offers next-day funding, and same-day funding is available to certain customers. With a decent range of POS hardware, modern e-commerce payment software, and plenty of support to help your business grow, this payment processor is a good choice for small- to medium-sized businesses that need reliable access to their money.

There are a few caveats to be aware of, however. You’ll need to have a Chase Business Banking account if you want to access same-day funding, which can come with extra costs. These costs can be waived, but only if you’re able to maintain a minimum $2,000 daily balance.

On top of that, Chase (and JP Morgan, its parent company) have mixed reviews from existing customers, with some claiming their account was closed or funds put on hold with no warning. Of course, it’s difficult to know the full circumstances underlying these reports. It’s also worth noting that disgruntled customers are more likely to share their experiences than satisfied customers are to share theirs.

So is Chase Payment Solutions℠ all that it claims to be? Keep reading to see if your business could benefit from using this credit card processor.

Quick Note

Chase Payment Solutions℠ was formally called Chase Merchant Services, and before that, Chase Paymentech. You may find that review aggregators, e-commerce integrations, and other sources of information still refer to Chase by these former names. This can make information harder to find, which is why I’ve done my best to collate all available information into this review.