If you need to start accepting payments online without breaking the bank, you’re in the right place. I’ve researched the 10 best payment gateways of 2026 that combine easy setup with ultra-low fees – perfect for small businesses and e-commerce sites in the US.

Unlike basic gateways (like PayPal or Authorize.Net), my recommended solutions are full-service payment processors that include payment gateways. This way, you get more payment methods, better support, and lower costs than going with a standalone gateway.

Whether you run a subscription service, an online store, or a high-risk business, I’ve got you covered with gateways that support international sales, integrate with all major platforms, and offer POS hardware for omnichannel selling.

Paysafe is my top choice for its discounted access to Authorize.net, low fees, advanced security features, and support for global transactions. You can contact Paysafe for a quote or continue reading to explore additional options.

Short on Time? These Are the Best Payment Gateways in 2026

- Paysafe – Access to a gateway for international processing and low fees for high-value transactions.

- Leaders Merchant Services – Features a trusted payment gateway, low fees, and top-notch support.

- PaymentCloud – Provides a discounted gateway and high approval rate for high-risk digital businesses.

How Do Payment Gateways Work?

Payment gateways act as a digital bridge between your customer’s payment method (like a credit card or digital wallet) and your bank account. When a customer makes a purchase, the gateway securely encrypts and transmits payment data to the acquiring bank, which then communicates with the customer’s card issuer or payment service to approve or decline the transaction.

Meanwhile, the payment processor plays a crucial role in handling the actual flow of funds. It ensures the transaction is approved, transfers money to your account, and manages fees or chargebacks. Together, the gateway and processor create a seamless and secure payment experience for your business and customers.

What We Look For in the Best Payment Gateway

While researching various payment gateways, I specifically focused on these features and benefits to determine the best options for your business:

- Ease of use. I sifted through thousands of customer reviews to ensure my top recommendations provide a seamless payment experience. My suggestions can easily integrate with all major e-commerce platforms, including Shopify, WooCommerce, and WordPress. My picks also offer APIs for a customizable payment setup.

- Security. Merchants that accept card-not-present transactions can open themselves up to fraud. I looked for payment processors that provide advanced tools for fraud detection and protection, as well as prevention and risk management.

- Pricing. I found the best deal for every type of business and processing volume. My list has the best prices for small businesses that process low volume. High-volume businesses can save significantly with my subscription-based recommendations. I also tracked down the lowest fees for high-risk merchants and non-profit organizations.

- Analytics and reporting.Most of my recommendations have built-in or third-party business management software that allows you to monitor the performance of your business, manage transactions, and access reports that help you make better business decisions.

- Support for international transactions. All the payment processors on my list provide payment gateways that support international transactions in multiple currencies for US-based businesses.

Paysafe offers processing capabilities in 120+ markets and 45+ currencies, supporting over 250 payment types. This extensive range of payment solutions, paired with its low transaction fees of only 0.50% + $0.10, make Paysafe ideal for businesses that sell high-ticket items globally or operate on a subscription model.

You benefit from Paysafe’s direct partnership with Vindicia, an advanced subscription and payment recovery software. Vindicia’s solutions can help you improve customer retention, recover up to 50% of failed credit card transactions, and maximize revenue for your subscription business.

Paysafe provides the reliable Authorize.net payment gateway at a significant discount. You’ll get critical business features like advanced fraud protection, customer information management to streamline payments, digital invoicing, and more. One minor drawback with Paysafe is that you can’t apply online – you’ll need to speak with a customer agent. That said, I believe this approach is a great way to prevent unexpected account closures.

Features & Benefits

- Chargeback program. The Encytro program costs $29.95 per month per location, making you eligible to receive up to $250 in reimbursements for covered chargebacks. The program simplifies financial planning for businesses experiencing quite a few chargebacks.

- Robust API. The Paysafe API integrates seamlessly into existing systems, offering a customizable payment form and a single endpoint for multiple payment methods.

- Advanced security. Paysafe has a dedicated risk management team to help you mitigate fraud. It also offers the Enhanced Security package, which acts like an insurance policy against data breaches, providing peace of mind in an era where security attacks are common.

- MobilePay app. The MobilePay app by Paysafe enables on-the-go payment collection and business management, making it easier to manage your inventory and finances from anywhere.

Read our detailed Paysafe review to learn more.

| Payment Gateway | Authorize.net |

|---|---|

| Payout Time | 1-2 business days |

| Accepted Payment Methods | 250+ including, credit cards and debit cards, digital wallets, ACH, bank transfers |

| Transaction Fees on Cheapest Plan | 0.50% + $0.10 |

| Monthly Fee on Cheapest Plan | $7.95 |

Leaders Merchant Services (LMS) is a certified reseller of Authorize.net, one of the most secure payment gateways on the market, with web, retail, mobile, and mail order/telephone order (MOTO) payment solutions. Although Authorize.net boasts stellar e-commerce features, its pricing plans lack value, and its support is subparit. But you can get the best of all words when you pair it with LMS.

Authorize.net’s flexible API caters to different customization requirements. If you want greater control over the transaction journey, including custom payment forms and receipts, I’d suggest implementing the Advanced Integration Method. For basic customizations and minimal development resources, you can go with the Simple Integration Method or Certified Shopping Carts.

Getting Authorize.net through LMS will cost you less because you’ll avoid the 10¢ per transaction and batch processing fee that Authorize.net typically charges. LMS’s low subscription fee of $10/month includes valuable e-commerce features and responsive support. Just note that LMS’s average contract has a minimum duration of three years. Thankfully, its custom pricing allows you to pay only for what you need.

Features and Benefits

- International payments. As long as you’re a US-based business, you can accept payments online from anywhere worldwide for a small additional fee.

- Subscription tools. For an additional fee, LMS offers excellent recurring billing payment gateway tools to ensure your customers never miss a payment.

- Take payments on the go. Authorize.net’s free mobile app can process credit card payments anywhere. This is a great option if you sell at remote events like fairs. You can connect a card reader to your device or key in transactions directly on your mobile phone.

- Payment links. You can use these payment links everywhere – on your website, social media accounts, and in direct messages with customers. You can customize them with your logo, special offers, ads, and more. They’re great for fostering repeat business, too.

Read our Leaders Merchant Services review for our expert opinion.

| Payment Gateway | Authorize.net |

|---|---|

| Payout Time | 72 hours |

| Accepted Payment Methods | Credit and debit cards, ACH, digital wallets, bank transfers |

| Transaction Fees on Cheapest Plan | ~0.5% + $0.50 |

| Monthly Fee on Cheapest Plan | $10 |

3. PaymentCloud: Best Payment Gateway for High-Risk Businesses

With a 98% approval rate, PaymentCloud is a lifeline for anyone struggling to find processing options elsewhere. Combined with its fraud and chargeback prevention tools, it’s an ideal solution for high-risk merchant processing. Integration with Authorize.net adds advanced fraud features like the Advanced Fraud Detection Suite (AFDS), which includes 13 fraud filters such as transaction limits and IP blocking for suspicious regions.

PaymentCloud also integrates with other payment gateways like NMI, which is compatible with 125+ shopping carts. NMI also offers robust security features, such as tokenization and an iSpyFraud system that protects customers’ data during transactions.

PaymentCloud’s fee for high-risk businesses is typically 3.95% + 25¢ per transaction, which is high but reasonable for high-risk standards. If you run a low-risk business, you can expect to pay around 2% + 25¢ per transaction. There’s also a monthly fee of $19.95 for the Authorize.Net or NMI payment gateways.

Features and Benefits

- Hundreds of integrations. PaymentCloud supports hundreds of platforms. From Shopify to HubSpot, Slack, and WordPress, you can easily sync your payment gateway with tools you already use.

- Dedicated account managers. You’re assigned a dedicated account manager from day one, and they stick with you throughout the process. So, whichever payment gateway you choose, you can expect your account manager to help you set it up.

- Free hardware. PaymentCloud offers EMV- and NFC-compatible POS systems, wireless terminals, and mobile readers for iOS and Android. You can either return the equipment at the end of your contract or negotiate a purchase outright. PaymentCloud will also reprogram your existing hardware for you for free.

- Business funding options. Once you’ve processed with PaymentCloud for three months, you can explore tailored funding opportunities to support your business. The application process is simple and gives access to working capital when you need it most.

Read our PaymentCloud review to discover more benefits.

| Payment Gateway | Authorize.net, NMI, USAePay, and many more |

|---|---|

| Payout Time | 48 hours |

| Accepted Payment Methods | Credit and debit cards, digital wallets, ACH, bank transfers, cryptocurrency |

| Transaction Fees on Cheapest Plan | 2% + 25¢ |

| Monthly Fee on Cheapest Plan | $25.00 |

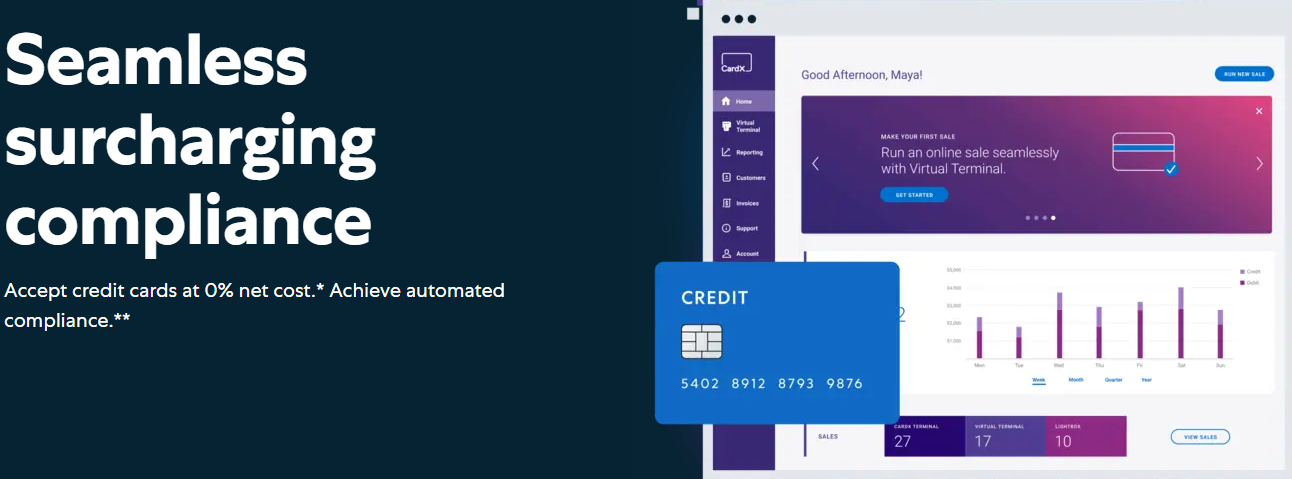

CardX’s Lightbox payment gateway lets you accept payments online for free by passing on the processing fees to the customer – 3.5% customer surcharge for credit cards. You’ll only pay 1.25% + 25¢ per transaction for debit card payments. Moreover, you don’t have to worry about exceeding the 4% compliance rule, as CardX keeps the surcharge capped at a manageable 3.5%.

One of my favorite features of CardX is its patent-pending card recognition technology. It automatically detects debit cards – even when customers mistakenly process them as credit cards without entering a PIN.

CardX’s gateway, Lightbox, also supports card-not-present transactions, such as those made over the phone or via mail. While it costs $29 per month – slightly higher than other payment gateways on this list – it offers powerful, advanced features.

Features and Benefits

- Assistance with transparency. CardX provides signage to clarify your surcharging policy. It also consolidates the purchase amount and credit card fee into a charge, simplifying billing and building customer trust.

- Special rates for institutions. If you’re part of a government or educational institution, you can accept credit and debit card payments at no cost. Your institution keeps 100% of the billed amount, while CardX collects the service fee and covers transaction costs.

- PCI compliance support. PCI compliance can be daunting, but with CardX, you’re not left in the dark. After your account is approved, a dedicated team walks you through achieving compliance at no extra cost.

- Complete POS setup. CardX equips you with everything you need to make in-person payments. Its custom Verifone VX520 terminal comes preloaded with proprietary software and all the essentials – signage, a guide, receipt paper, and cables.

See our CardX review for more details.

| Payment Gateway | Lightbox payment gateway (proprietary) |

|---|---|

| Payout Time | 24 hours |

| Accepted Payment Methods | Credit and debit cards, ACH (e-checks) |

| Transaction Fees on Cheapest Plan | 1.25% + 25¢ |

| Monthly Fee on Cheapest Plan | N/A |

5. Stax: Best Payment Gateway for High-Volume Businesses

Stax’s fixed monthly fee and industry-low transaction fees of only 10¢ + interchange (in-person) make it ideal for high-volume businesses. Starting at $99.00, its subscription fees might seem high, but if you process $8,000+/month in credit card payments, you can save up to 40% with Stax.

Stax offers Authorize.net’s payment gateway for only $12.95/month – a bargain compared to Authorize.net’s own $25/month fee. Stax also provides advanced API and developer-friendly tools to customize the checkout flow, add branded elements, and implement advanced fraud prevention measures.

Stax can be expensive if you process only a few thousand dollars a month. Although the transaction fees are low, the monthly subscription fee might be too much for small online businesses.

Features and Benefits

- Stax mobile app. This app allows you to manage every aspect of your business on the go at no additional charge. You can also turn any handheld device into a POS system. If you’re an online business but hold in-person events occasionally, this feature will save you from investing in dedicated POS equipment.

- Invoicing tools. Stax makes it easy to set up recurring payments. It also provides branded payment links, allowing customers to make quick payments. With Text2Pay, your customers can conveniently respond to texts to initiate payments. Best of all, these tools are included in your monthly fee.

- Effortless shopping cart setup. You can set up a custom shopping cart with a single click. Simply add the products or services you sell, click ‘create’, and you’re all set to start taking orders.

- One-click checkout. Your customers can complete their purchases in just a click, reducing friction and increasing spending.

Read our expert Stax review for more features.

| Payment Gateway | Authorize.net |

|---|---|

| Payout Time | 72 hours as standard, same-day payout for an extra fee |

| Accepted Payment Methods | Credit and debit cards, digital wallets, bank transfers, ACH |

| Transaction Fees on Cheapest Plan | 10¢ + interchange (in-person) |

| Monthly Fee on Cheapest Plan | $99.00 |

Payment Depot’s interchange-plus pricing is well-suited for businesses with unpredictable or seasonal sales, such as florists, holiday shops, or tourism companies. Instead of paying inflated rates during busy months, you pay a fair, transparent fee (between 0.2%-1.95%) that keeps costs manageable whether sales are booming or slowing down – no monthly fees.

Payment Depot works smoothly with popular gateways like Authorize.net, Stripe, and PayPal, making it easy for you to plug into systems you may already use. This flexibility means you don’t have to overhaul your setup to accept payments efficiently.

Through Authorize.net, Payment Depot offers Buy buttons that take customers straight to checkout. You can design a customized checkout experience using Payment Depot’s ready-made shopping cart templates or build one from scratch. Just note that Payment Depot doesn’t offer same-day payouts, which could be a drawback if you depend on quick cash flow.

Features and Benefits

- Shopping cart integrations. In addition to proprietary shopping cart solutions, Payment Depot integrates with a variety of popular shopping carts, such as OpenCart, 3D Cart, and ZenCart, making it adaptable for different online businesses.

- E-commerce integrations. Payment Depot also integrates with major e-commerce platforms such as BigCommerce, Magento, and WooCommerce. This ensures that your existing or upcoming online store can easily connect with the payment processing system, streamlining operations and sales management.

- 24/7 risk monitoring team. Payment Depot takes a proactive approach to risk management. Its dedicated team monitors for changes in bank policies and is always on the lookout for the latest fraud methods, acting swiftly to mitigate risks. You can also dispute chargebacks directly from your account. This integrated system, with all necessary information in one place, is a significant time-saver.

- Complimentary terminal. Payment Depot provides one Dejavoo terminal without a contract. For some businesses, Payment Depot may even offer multiple free Dejavoo terminals, which can help cut physical payment processing costs.

Read our expert Payment Depot review for more information.

| Payment Gateway | Authorize.net |

|---|---|

| Payout Time | 24 hours |

| Accepted Payment Methods | Credit and debit cards, digital wallets, bank transfers, ACH |

| Transaction Fees on Cheapest Plan | 0.2%-1.95% |

| Monthly Fee on Cheapest Plan | $0 |

Other Notable Payment Gateways

7. Square

Square is popular with small online and in-store businesses because it’s easy to use. You can quickly start taking payments with Square’s proprietary payment gateway solution and POS devices. It even offers a free online store, making it affordable to set up shop online. Whether your business is offline, online, or both, Square has something to offer.

However, Square doesn’t cater to high-risk merchants. Because of the lack of proper vetting, Square is known for terminating accounts or freezing funds without prior notice if it deems a merchant high risk. Also, you might find its customer support hard to reach, posing potential troubleshooting challenges.

8. Chase Payment Solutions

Small e-commerce businesses facing cash flow challenges will find Chase Payment Solutions ideal. If you sign up for a Chase Business Checking account, you can enjoy same-day deposits for in-person, mobile, and e-commerce sales at no additional cost. You also get access to Authorize.net and a one-stop integration with the popular platform BigCommerce.

Chase doesn’t charge monthly fees, and online transactions start at 2.6% + 10¢ per transaction. That said, Chase doesn’t widely support third-party POS integrations and doesn’t provide free equipment. However, this may not be an issue if your business operates exclusively or primarily online.

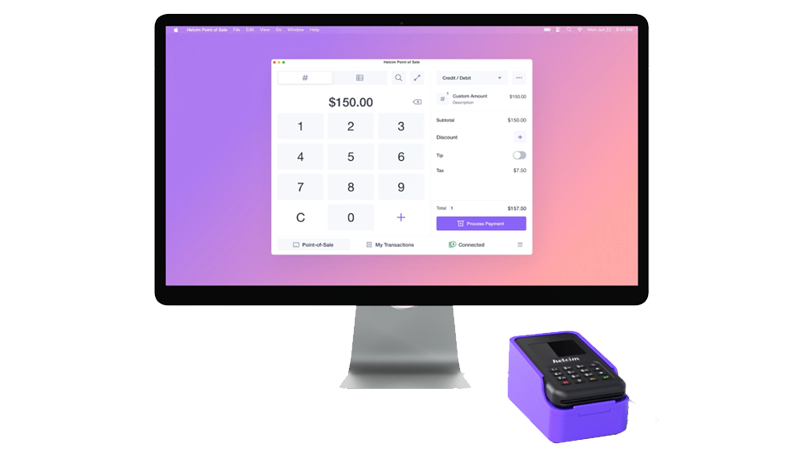

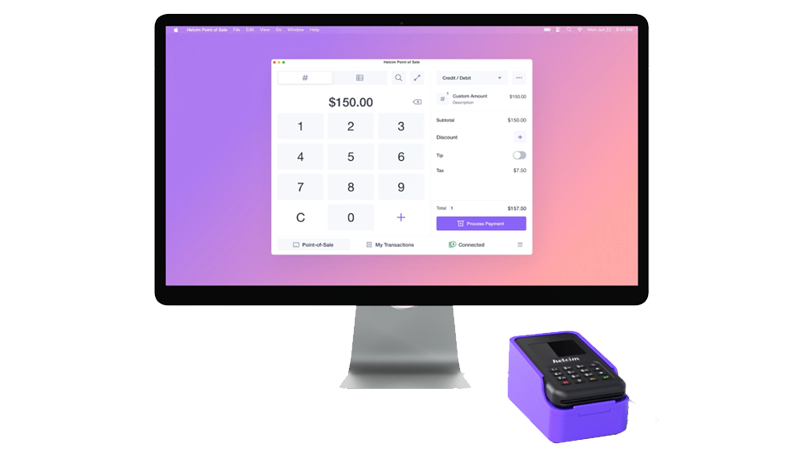

9. Helcim

Helcim gives you access to its payment gateway solutions at no extra cost, including a virtual terminal, online checkout, hosted payment pages, and the Helcim Pay.js integration. Helcim offers a fully hosted e-commerce system and an intuitive online store builder, making it ideal for new and low-volume e-commerce businesses. It’s also a good option for restaurants thanks to its proprietary food ordering system.

However, Helcim doesn’t serve high-risk merchants, which can be a roadblock for certain business types. Also, Helcim doesn’t integrate with third-party POS devices, which can be limiting, especially if you’ve already invested in other equipment. Despite these constraints, Helcim simplifies e-commerce complexities for startups.

10. POS Pros

POS Pros is a great option if you’re primarily a brick-and-mortar business and need a reliable payment gateway. You’ll get access to dozens of point-of-sale payment gateways, including popular options like Clover and Toast. A specialist will be available to offer free virtual demos, allowing you to select the best POS solution for your specific needs. Additionally, POS Pros gives you access to the trusted Authorize.Net at a discounted price.

While it excels for POS support, POS Pros offers minimal e-commerce features. Competitive card-present transaction fees and a wide range of POS devices make POS Pros great for businesses selling in person. However, if you prioritize e-commerce, I recommend checking out Leaders Merchant Services’ high-converting features.

Popular Standalone Payment Gateways

While many businesses would be better off with a payment processor that includes a gateway, some standalone payment gateways offer compelling features. Below, I’ve highlighted some of the most well-known options.

PayPal

PayPal is one of the most widely recognized payment gateways. It’s easy to set up and is great for small businesses, freelancers, and e-commerce startups. With PayPal, your customers can pay using their PayPal balance, credit cards, or even buy-now-pay-later options like PayPal Credit. However, PayPal’s transaction fees can add up, and withdrawing funds to your bank account isn’t always instant, which can be an issue if you run a cash flow-sensitive business.

Stripe

Stripe is a developer-friendly payment gateway that lets you create tailored checkout experiences, automate payouts, and integrate subscription billing. It supports multiple currencies, making it a great option for global businesses. However, while Stripe’s flexibility is a big plus, it requires some technical knowledge to set up and maintain. Additionally, competitors like Helcim and Stax (listed above) offer comparable flexibility to Stripe, albeit at lower costs.

Authorize.Net

Authorize.Net supports various payment methods, including credit cards, e-checks, and contactless payments. It also provides advanced fraud detection tools, so it’s great for online businesses that want extra security. That said, Authorize.Net’s pricing structure, which includes a monthly fee on top of transaction costs, is quite pricey compared to competitors that offer more straightforward, flat-rate pricing.

Shopify Payments

Shopify Payments is a built-in payment solution for Shopify users. Since it’s directly integrated with Shopify, businesses can accept payments without extra transaction fees (if they stick to Shopify Payments). However, Shopify Payments is limited to Shopify users only, and if a Shopify store owner decides to use an external gateway, they’ll have to pay additional fees.

Amazon Pay

Amazon Pay lets customers use the payment details already stored in their Amazon accounts, making checkout faster and more convenient. This can help reduce cart abandonment. However, Amazon Pay is best suited for online retailers whose customers are already comfortable with Amazon’s ecosystem.

Braintree

Braintree, a PayPal-owned service, offers a flexible payment solution that supports credit cards, digital wallets such as Apple Pay and Google Pay, and PayPal itself. It’s known for its transparent flat-rate pricing and global reach. Developers appreciate its robust API, though smaller businesses may find the setup process complex and convoluted.

Why Choosing a Payment Processor with a Gateway is a Better Option

Now, while standalone payment gateways offer useful features, many businesses can benefit from accessing a payment gateway through a credit card processor. Payment processors don’t just facilitate transactions – they provide added value, like better customer support and advanced POS systems for your physical locations. You’ll also gain access to additional features like subscription billing, detailed analytics, and flexible payment options.

One key advantage of my recommended payment processors is that they provide free or discounted access to the payment gateways they integrate with. This means you’ll save more than using the gateway as a standalone online payment processing service. By choosing a payment processor that includes a gateway, you not only cut costs but also gain more flexibility (e.g., POS devices and other physical terminals) and overall better value for your business.

Select the Best Payment Gateway for Your Business

Bundling your payment gateway with a reliable payment processor is a winning combination as you’ll get better features, lower fees, and additional support.

For online businesses processing high-ticket transactions globally, Paysafe offers discounted access to Authorize.net, low online transaction fees, and support for international transactions. It also provides advanced subscription management features and an attractive chargeback management program.

If you’re a low- to mid-volume digital business, Leaders Merchant Services (LMS) and Authorize.net make the best bundle. LMS balances affordable payment processing, exceptional customer support, and valuable e-commerce features like payment links and subscription tools.

If you operate a high-risk e-commerce business, PaymentCloud has a 98% approval rate. It offers Authorize.net at a discounted price, providing you with access to both platforms’ robust fraud and chargeback prevention tools.

Take a look at my bite-sized table for a quick comparison of my top recommendations that offer payment gateway solutions:

| Best Feature | Best For | Monthly fee on cheapest plan | Transaction fees on cheapest plan | ||

|---|---|---|---|---|---|

| Paysafe | Support for international processing | Businesses processing high-ticket transactions (globally) | $7.95 | 0.50% + $0.10 | |

| Leaders Merchant Services | Affordable, custom pricing | Low- to mid-volume businesses | $10 | ~0.5% + $0.50 | |

| PaymentCloud | 98% approval rate | High-risk online businesses | $25.00 | 2% + 25¢ | |

| CardX | Automated surcharging | Businesses that want to process zero-cost transactions | N/A | 3.5% customer surcharge | |

| Stax | 40% discount on payment processing fees | High-volume businesses processing $8,000+/month | $99.00 | 10¢ + interchange (in-person) | |

| Payment Depot | Flexible interchange plus pricing | Businesses with unpredictable volumes | N/A | 0.2%-1.95% |

FAQ

What’s the difference between a payment gateway and a payment processor?

A payment gateway securely encrypts and transmits your customer’s payment information to the payment processor. The payment processor then communicates with the issuing bank to authorize the transaction and transfers the funds to your merchant account.

Which is the best payment gateway for international transactions?

Paysafe integrates with the trusted Authorize.net payment gateway at a discounted rate and offers support for processing transactions in 120+ markets globally and 45+ currencies. Its risk monitoring, chargeback mitigation, and privacy features, such as end-to-end encryption and fraud detection, guarantee secure international transactions.

What is the cheapest way to take card payments?

The most cost-effective way to process card payments is by utilizing a payment gateway with low per-transaction rates. For example, Leaders Merchant Services partners with the popular Authorize.net gateway at a much lower rate than usual and is open to negotiating suitable rates for your business.

What is the best payment gateway?

The best payment gateway depends on your type of business. If you run a global conglomerate, I highly recommend Paysafe because of its support for international transactions. Leaders Merchant Services is my top choice if you’re a low- to mid-volume business. However, if you fall under the high-risk business category, PaymentCloud is the best option. All these options will give you access to the trusted Authorize.net payment gateway at a discounted price.

What are common payment gateway costs?

Common payment gateway costs include setup fees, monthly gateway fees, transaction fees, and additional fees for specific features or services. Setup fees can range from zero to a few hundred dollars. Monthly gateway fees are around $10 to $30/month. Transaction fees are typically a percentage of the transaction amount, ranging from 1% to 3% or more. To avoid high costs, consider exploring our list of the most affordable payment gateways.